The Top 10 Pharmaceutical Companies of 2022: A Global Ranking

Fuelled by new product launches and an aging population, the global pharmaceutical industry continues to grow and was up by a remarkable US$1.4 trillion in 2021. New medications are constantly being developed, approved and marketed, resulting in significant market growth. Despite disruptions as a result of the Covid-19 pandemic, pharmaceutical companies have remained agile and the FDA approved 50 drugs in 2021, making it the fourth-best year after 2018 (59 drugs) and 1996 and 2020 (53 each).

Mergers and acquisitions (M&A) are gradually changing the marketplace and some of the largest pharma companies have been strengthened through joining forces with or being bought out by other businesses. In 2021, notable changes in the market have included:

- Abbvie completing the acquisition of Allergan

- Roche completing the repurchase of its shares held by Novartis

- Merck announcing it is buying Acceleron Pharma

- AstraZeneca acquiring speciality drugmaker Alexion

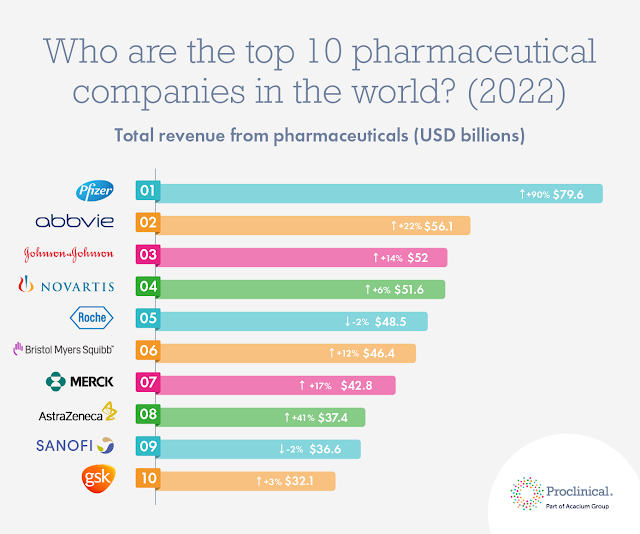

The below list of top 10 biggest pharma companies in the world in 2022 is ranked by 2021 revenue for pharmaceutical sales only:

10. GSK (US$32.1BN +3%)

In tenth place is UK-based multinational company, GlaxoSmithKline. Formed by the merger of Glaxo Wellcome plc and SmithKline Beecham plc in 2000, GSK specialises in fields of pharmaceutical, biologics, vaccines and consumer healthcare. In 2021, sales for the companies, pharmaceuticals and vaccines segments added up to US$32bn, up by 3%.

The pharma division was powered by sales for Xevudy, the monoclonal antibody treatment for Covid-19 which contributed approximately 6 percentage points to total Pharmaceuticals growth. Turnover for vaccines was up by 2% CER driven by pandemic sales but partially offset by lower demand for routine adult vaccination due to Covid-19.

In early 2022, GSK announced its plans to demerge its consumer healthcare division and form a new company called Haleon in mid-2022. The demerger, will allow GSK to focus purely on biopharmaceuticals, prioritising investment towards the development of innovative vaccines and specialty medicines.

9. SANOFI (US$36.6BN -2%)

French multinational pharmaceutical giant, Sanofi, is the ninth largest pharmaceutical company in the world by revenue. Sanofi provides healthcare solutions to over 100 countries worldwide and has three core focuses: speciality care, vaccines, and general medicines.

In 2021, Sanofi’s pharmaceutical and vaccine segments sales combined totalled US$36.6mn (€33.3mn). Sales were down by 2% impacted by unfavourable exchange rates, but were up by 5% in euros, which is what the company report their sales in. The company’s pharmaceuticals division is made up of speciality care drugs and general medicines. Eczema treatment, Dupixen, remained a key driver of growth with reported sales up by 48%. Vaccines grew well in full-year 2021 but started to slow in Q4 reflecting low 2021 US influenza vaccination rates.

The company launched a new brand identity in early 2022, which kicked-started a new long term growth strategy for the business, with strong pipelines for innovative medicine in oncology, inflammation and immunology. Looking ahead, Sanofi plans to continue to invest in R&D to further strengthen their pipelines.

8. ASTRAZENECA (US$37.4BN +41%)

After acquiring Alexion, AstraZeneca rockets into eighth place in 2022. Headquartered in Cambridge, UK, AstraZeneca specialises in providing solutions for major disease areas, including oncology, cardiovascular, gastrointestinal, infection, neuroscience, respiratory, and inflammation.

In 2021, AstraZeneca generated revenues of US$37.4, up by an impressive 41%. Growth was well balanced across all of the company’s key areas of focus, with double-digit growth in all major regions, including Emerging Markets, despite some challenging conditions in China. Growth was largely owing to the acquisition of American pharma company, Alexion, which the company completed in July 2021. Following the acquisition, Rare Disease medicines generated 8% of AstraZeneca’s full year 2021 total revenue, growing by 8%. Oncology accounted for 38% of the company’s revenues and grew by 19% in 2021. Increased reimbursement and launches offset the impact of Covid-19 on diagnosis and treatment rates.

AstraZeneca and Oxford University launched their Covid-19 vaccine in January 2021, since then over 2.5 billion doses were released for supply around the world. Product sales amounted to US$3,917mn in the year 2021. AstraZeneca also launched Evusheld, which was approved to prevent Covid-19 in people whose immune response is weakened, which has showed success in Europe and emerging markets.

Looking ahead, AstraZeneca plans to continue delivering growth through innovation, by supporting its multiple blockbuster medicines, continuing to invest in clinical stage pipeline and working on strategic clinical stage business development.

7. MERCK & CO (US$42.8BN +17%)

A staple to the top 10 pharmaceutical companies is American multinational, Merck & Co. Founded in 1891, Merck is headquartered in New Jersey and focuses on pharmaceuticals, vaccines and animal health. With 68,000 employees worldwide, the company is well known for its contributions to diabetes and cancer care. In 2021, Merck’s pharma sales rose by 17%, primarily due to higher sales in oncology, reflecting strong growth of blockbuster Keyturda, higher sales of vaccines, as well as growth in hospital acute care products. Covid-19 continued to negatively impact sales in 2021, but to a lesser extent than in 2020.

As Keytruda, a constant star performer for Merck, moves toward the loss of market exclusivity in 2028, Merck has had to look for new avenues for growth. In late 2021, it was announced the Merck was buying Acceleron Pharma for US$11.5bn, broadening its portfolio with potential treatments that could bring in fresh revenue for the company.

In the announcement of the company’s full-year results, Kenneth C. Frazier, chairman and CEO of Merck commented “Our scientists continue to advance our internal pipeline of promising medicines and vaccines, including in oncology, HIV, and pneumococcal disease, and, more recently, therapeutics for Covid-19. These pipeline developments provide us with increasing line-of-sight to significant potential growth drivers later this decade and into the next.”

6. BRISTOL-MYERS SQUIBB (US$46.4BN +12%)

Taking the sixth place in 2022 is global pharmaceutical company, Bristol-Myers Squibb. With 135 years in business, the company has made significant medical advancements in oncology, hematology, immunology and cardiovascular disease. Bristol-Myers Squibb’s sales totalled US$46.4bn, up by 12%, driven by stroke medication, Eliquis, Immuno-Oncology, and new product portfolios. In the full year earnings call, Giovanni Caforio, M.D., board chair and chief executive officer commented “2021 was a pivotal year for our company as we achieved significant regulatory and clinical milestones and positioned the company to successfully renew our portfolio. I am confident in our ability to execute against our key milestones in 2022, including three planned first-in-class launches with relatlimab plus nivolumab fixed-dose combination, mavacamten and deucravacitinib. Our financial strength, dedicated workforce and proven ability to execute will enable us to continue to advance our pipeline, invest in future sources of innovation and position the company for sustained growth.”

5. ROCHE (US$48.5BN -2%)

Former number one, Roche, slips into fifth place on this year’s list of top pharmaceutical companies. With a workforce of over 90,000 and headquarters based in Basel, Switzerland, Roche is at the forefront of oncology, immunology, infectious diseases, ophthalmology and neuroscience. In 2021, the pharmaceutical segment accounted for 72% of their overall revenues, with sales totalling US$48.5bn, down by 2% on prior year but up by 3% at constant exchange rates (2021: CHF 45.0 billion and 2020: CHF 44.5 billion). After a tough 2020 of being negatively impacted by the pandemic, with patients avoiding visiting their healthcare providers, Roche’s pharma division started to get back on track in 2021 with the uptake of new medicines compensating for the biosimilar competition. However, Roche’s Diagnostics division (not included in our figures) continued to take centre stage in 2021 as countries across the world worked to track Covid-19 infections.

In December, Roche completed the repurchase of its shares held by rival Novartis, restoring their strategic flexibility and retaining their operational scope. Looking to the future, Roche continues to develop its capabilities, and build partnerships, ready to deliver on the next stage in personalised healthcare, and has a very strong pipeline for the year ahead with 14 new molecular entities in late-stage trials.

4. NOVARTIS (US$51.6BN +6%)

Just missing out on a place in the top 3 is Swiss multinational pharmaceutical company, Novartis, which has developed, manufactured and marketed breakthrough medicines for over 250 years. Now with presence in 155 countries across the world, Novartis focuses on innovative medicines as well as generics and biosimilars.

Over the course of 2021, Novartis continued to build depth in their five core therapeutic areas (Cardio-Renal, Immunology, Neuroscience, Oncology and Hematology), strengthen their technology platforms, and create a balanced geographic footprint. The company’s pharmaceutical full year revenues rose by a solid 6%, powered by a strong performance for the Innovative Medicines division, with a number of key growth drivers including heart failure treatment, Entresto (+40% cc), newly approved for the treatment of arthritis, Cosentyx (+17%), a spinal muscular atrophy therapy, Zolgensma (+46% ), a multiple sclerosis injection, Kesimpta (US$372 mn), a thrombocytopenia and severe aplastic anemia drug, Promacta/Revolade (+15%) and breast cancer treatment, Kisqali (+36%).

Sales for the company’s Sandoz division were up by 2%. However, Novartis is undergoing a strategic review of Sandoz and expect to provide an update, at the latest, by the end of 2022. The review will explore all options, ranging from retaining the business to separation, in order to determine how to move forward.

With several patent losses in 2020, the company faced stiff competition from the scientific advances of other company’s new products but is committed to remaining a medicine-focussed company. Consistent with their strategy, in November 2021, Novartis agreed to sell its stake in Roche back to its rival for US$20.7 billion — bringing a 20-year investment to an end. In a press release announcing the transaction Novartis CEO Vas Narasimhan said, “We intend to deploy the proceeds from the transaction in line with our capital allocation priorities to maximize shareholder value and continue to reimagine medicine.”

3. JOHNSON & JOHNSON (US$52BN +14%)

Johnson & Johnson, also referred to as J&J, secures third place on this year’s top pharmaceutical companies list. With headquarters based in New Jersey, Johnson & Johnson develops and produces pharmaceuticals, medical devices and consumer health goods. Sales for the company’s pharmaceutical division grew by 14% on a year-on-year basis driven by a number of key performers, including Darzalex, a treatment of multiple myeloma, Stelara, a treatment of a number of immune-mediated inflammatory diseases, Tremfya, a plaque psoriasis and psoriatic arthritis treatment, Erleada, a prostate cancer drug, and Invega sustenna/xeplion/Invega trinza/trevicta, an injectable atypical antipsychotic for the treatment of schizophrenia in adults.

In addition, J&J’s single-dose Covid-19 vaccine was approved for emergency use by the FDA in early 2021, which contributed to high growth for the company’s pharma division with revenues of US$2.3bn. However, this was offset by a lacklustre performance for remicade, a treatment for immune-mediated inflammatory diseases.

In January 2022, Joaquin Duato became Johnson & Johnson's new Chief Executive Officer. In J&J’s full-year earnings call he commented "Given our strong results, financial profile, and innovative pipeline, we are well-positioned for success in 2022 and beyond."

2. ABBVIE (US$56.1BN +22%)

Innovation-driven AbbVie is the second largest pharma company by revenue this year. AbbVie was created in 2013, when the company separated from Abbott. Employing 47,000 experts worldwide in 70+ countries, AbbVie tends to drive its R&D efforts towards difficult-to-cure diseases and successfully acquired Allergan, which completed in May 2020, strengthening the company’s position in a number of therapeutic areas including immunology, oncology and neuroscience.

In 2021, AbbVie’s sales totalled US$56.1bn, with year-on-year growth up by an impressive 22%. This was driven by a solid performance for the company’s immunology portfolio which generated sales of $25.28bn, growing by 14.1% on a reported basis and 13.5% on an operational basis. AbbVie’s hematologic oncology and neuroscience portfolios also delivered with sales increasing by 8.7% and 69.5%, respectively.

Looking ahead, AbbVie’s rheumatoid arthritis blockbuster, Humira, is set to face competition in the next year as there are biosimilars on track for early entry. However, there is still expected to be demand for the treatment, Humira. Those sales, plus growing contributions from the Jak inhibitor Rinvoq, psoriasis product Skyrizi and cancer drug Venclexta, are expected to greatly strengthen AbbVie’s market position.

1. PFIZER (US$79.6BN +90%)

Pfizer, takes the top spot in 2022, rising from sixth in 2021. Pfizer, specialises in the development of medicines and vaccines across a wide range of disciplines including immunology, oncology, cardiology and neurology. Last year, their sales were down by 19% as a result of the spin-off of Upjohn, which completed in Q4 2020. Since then, the company has moved forward as a single focused innovative biopharmaceutical company, working on the discovery, development, manufacturing, marketing, sales and distribution of biopharmaceutical products worldwide.

In the fiscal year of 2021, Pfizer’s sales accelerated to an impressive US$79.6bn with their year-on-year growth up 90%, thanks to its top-selling product Comirnaty, a Covid-19 vaccine, which generated sales of almost US$37bn. For the last two years, Pfizer have focussed much of their resources to help provide solutions to the Covid-19 pandemic, which has really strengthened their positioning within the pharmaceutical industry. In 2020, with their partner BioNTech, Pfizer became the first company to successfully develop a vaccine against Covid-19. Since being approved for emergency use, millions of people across the world have been given the Comirnaty vaccine and it has saved countless lives. In December 2021, Pfizer made another major step forward in the fight against the global pandemic when the FDA announced they had approved Paxlovid, the first treatment for Covid-19 that is taken orally in the form of a pill.

Looking ahead, the CEO Albert Bourla has announced plans for the company to aggressively expand the use of the Covid-19 vaccine’s technology, messenger RNA, to treat rare genetic diseases of the liver, muscles, and central nervous system through a collaboration with Beam Therapeutics. The company has also teamed up with BioNTech again to develop a shingles vaccine, which is expected to be the first mRNA-based vaccine to treat the disease.

Related: Top 10 drugs by worldwide sales in 2021

|

| Credit: ProClinical.com |

Mergers and acquisitions (M&A) are gradually changing the marketplace and some of the largest pharma companies have been strengthened through joining forces with or being bought out by other businesses. In 2021, notable changes in the market have included:

- Abbvie completing the acquisition of Allergan

- Roche completing the repurchase of its shares held by Novartis

- Merck announcing it is buying Acceleron Pharma

- AstraZeneca acquiring speciality drugmaker Alexion

The below list of top 10 biggest pharma companies in the world in 2022 is ranked by 2021 revenue for pharmaceutical sales only:

10. GSK (US$32.1BN +3%)

In tenth place is UK-based multinational company, GlaxoSmithKline. Formed by the merger of Glaxo Wellcome plc and SmithKline Beecham plc in 2000, GSK specialises in fields of pharmaceutical, biologics, vaccines and consumer healthcare. In 2021, sales for the companies, pharmaceuticals and vaccines segments added up to US$32bn, up by 3%.

The pharma division was powered by sales for Xevudy, the monoclonal antibody treatment for Covid-19 which contributed approximately 6 percentage points to total Pharmaceuticals growth. Turnover for vaccines was up by 2% CER driven by pandemic sales but partially offset by lower demand for routine adult vaccination due to Covid-19.

In early 2022, GSK announced its plans to demerge its consumer healthcare division and form a new company called Haleon in mid-2022. The demerger, will allow GSK to focus purely on biopharmaceuticals, prioritising investment towards the development of innovative vaccines and specialty medicines.

9. SANOFI (US$36.6BN -2%)

French multinational pharmaceutical giant, Sanofi, is the ninth largest pharmaceutical company in the world by revenue. Sanofi provides healthcare solutions to over 100 countries worldwide and has three core focuses: speciality care, vaccines, and general medicines.

In 2021, Sanofi’s pharmaceutical and vaccine segments sales combined totalled US$36.6mn (€33.3mn). Sales were down by 2% impacted by unfavourable exchange rates, but were up by 5% in euros, which is what the company report their sales in. The company’s pharmaceuticals division is made up of speciality care drugs and general medicines. Eczema treatment, Dupixen, remained a key driver of growth with reported sales up by 48%. Vaccines grew well in full-year 2021 but started to slow in Q4 reflecting low 2021 US influenza vaccination rates.

The company launched a new brand identity in early 2022, which kicked-started a new long term growth strategy for the business, with strong pipelines for innovative medicine in oncology, inflammation and immunology. Looking ahead, Sanofi plans to continue to invest in R&D to further strengthen their pipelines.

8. ASTRAZENECA (US$37.4BN +41%)

After acquiring Alexion, AstraZeneca rockets into eighth place in 2022. Headquartered in Cambridge, UK, AstraZeneca specialises in providing solutions for major disease areas, including oncology, cardiovascular, gastrointestinal, infection, neuroscience, respiratory, and inflammation.

In 2021, AstraZeneca generated revenues of US$37.4, up by an impressive 41%. Growth was well balanced across all of the company’s key areas of focus, with double-digit growth in all major regions, including Emerging Markets, despite some challenging conditions in China. Growth was largely owing to the acquisition of American pharma company, Alexion, which the company completed in July 2021. Following the acquisition, Rare Disease medicines generated 8% of AstraZeneca’s full year 2021 total revenue, growing by 8%. Oncology accounted for 38% of the company’s revenues and grew by 19% in 2021. Increased reimbursement and launches offset the impact of Covid-19 on diagnosis and treatment rates.

AstraZeneca and Oxford University launched their Covid-19 vaccine in January 2021, since then over 2.5 billion doses were released for supply around the world. Product sales amounted to US$3,917mn in the year 2021. AstraZeneca also launched Evusheld, which was approved to prevent Covid-19 in people whose immune response is weakened, which has showed success in Europe and emerging markets.

Looking ahead, AstraZeneca plans to continue delivering growth through innovation, by supporting its multiple blockbuster medicines, continuing to invest in clinical stage pipeline and working on strategic clinical stage business development.

7. MERCK & CO (US$42.8BN +17%)

A staple to the top 10 pharmaceutical companies is American multinational, Merck & Co. Founded in 1891, Merck is headquartered in New Jersey and focuses on pharmaceuticals, vaccines and animal health. With 68,000 employees worldwide, the company is well known for its contributions to diabetes and cancer care. In 2021, Merck’s pharma sales rose by 17%, primarily due to higher sales in oncology, reflecting strong growth of blockbuster Keyturda, higher sales of vaccines, as well as growth in hospital acute care products. Covid-19 continued to negatively impact sales in 2021, but to a lesser extent than in 2020.

As Keytruda, a constant star performer for Merck, moves toward the loss of market exclusivity in 2028, Merck has had to look for new avenues for growth. In late 2021, it was announced the Merck was buying Acceleron Pharma for US$11.5bn, broadening its portfolio with potential treatments that could bring in fresh revenue for the company.

In the announcement of the company’s full-year results, Kenneth C. Frazier, chairman and CEO of Merck commented “Our scientists continue to advance our internal pipeline of promising medicines and vaccines, including in oncology, HIV, and pneumococcal disease, and, more recently, therapeutics for Covid-19. These pipeline developments provide us with increasing line-of-sight to significant potential growth drivers later this decade and into the next.”

6. BRISTOL-MYERS SQUIBB (US$46.4BN +12%)

Taking the sixth place in 2022 is global pharmaceutical company, Bristol-Myers Squibb. With 135 years in business, the company has made significant medical advancements in oncology, hematology, immunology and cardiovascular disease. Bristol-Myers Squibb’s sales totalled US$46.4bn, up by 12%, driven by stroke medication, Eliquis, Immuno-Oncology, and new product portfolios. In the full year earnings call, Giovanni Caforio, M.D., board chair and chief executive officer commented “2021 was a pivotal year for our company as we achieved significant regulatory and clinical milestones and positioned the company to successfully renew our portfolio. I am confident in our ability to execute against our key milestones in 2022, including three planned first-in-class launches with relatlimab plus nivolumab fixed-dose combination, mavacamten and deucravacitinib. Our financial strength, dedicated workforce and proven ability to execute will enable us to continue to advance our pipeline, invest in future sources of innovation and position the company for sustained growth.”

5. ROCHE (US$48.5BN -2%)

Former number one, Roche, slips into fifth place on this year’s list of top pharmaceutical companies. With a workforce of over 90,000 and headquarters based in Basel, Switzerland, Roche is at the forefront of oncology, immunology, infectious diseases, ophthalmology and neuroscience. In 2021, the pharmaceutical segment accounted for 72% of their overall revenues, with sales totalling US$48.5bn, down by 2% on prior year but up by 3% at constant exchange rates (2021: CHF 45.0 billion and 2020: CHF 44.5 billion). After a tough 2020 of being negatively impacted by the pandemic, with patients avoiding visiting their healthcare providers, Roche’s pharma division started to get back on track in 2021 with the uptake of new medicines compensating for the biosimilar competition. However, Roche’s Diagnostics division (not included in our figures) continued to take centre stage in 2021 as countries across the world worked to track Covid-19 infections.

In December, Roche completed the repurchase of its shares held by rival Novartis, restoring their strategic flexibility and retaining their operational scope. Looking to the future, Roche continues to develop its capabilities, and build partnerships, ready to deliver on the next stage in personalised healthcare, and has a very strong pipeline for the year ahead with 14 new molecular entities in late-stage trials.

4. NOVARTIS (US$51.6BN +6%)

Just missing out on a place in the top 3 is Swiss multinational pharmaceutical company, Novartis, which has developed, manufactured and marketed breakthrough medicines for over 250 years. Now with presence in 155 countries across the world, Novartis focuses on innovative medicines as well as generics and biosimilars.

Over the course of 2021, Novartis continued to build depth in their five core therapeutic areas (Cardio-Renal, Immunology, Neuroscience, Oncology and Hematology), strengthen their technology platforms, and create a balanced geographic footprint. The company’s pharmaceutical full year revenues rose by a solid 6%, powered by a strong performance for the Innovative Medicines division, with a number of key growth drivers including heart failure treatment, Entresto (+40% cc), newly approved for the treatment of arthritis, Cosentyx (+17%), a spinal muscular atrophy therapy, Zolgensma (+46% ), a multiple sclerosis injection, Kesimpta (US$372 mn), a thrombocytopenia and severe aplastic anemia drug, Promacta/Revolade (+15%) and breast cancer treatment, Kisqali (+36%).

Sales for the company’s Sandoz division were up by 2%. However, Novartis is undergoing a strategic review of Sandoz and expect to provide an update, at the latest, by the end of 2022. The review will explore all options, ranging from retaining the business to separation, in order to determine how to move forward.

With several patent losses in 2020, the company faced stiff competition from the scientific advances of other company’s new products but is committed to remaining a medicine-focussed company. Consistent with their strategy, in November 2021, Novartis agreed to sell its stake in Roche back to its rival for US$20.7 billion — bringing a 20-year investment to an end. In a press release announcing the transaction Novartis CEO Vas Narasimhan said, “We intend to deploy the proceeds from the transaction in line with our capital allocation priorities to maximize shareholder value and continue to reimagine medicine.”

3. JOHNSON & JOHNSON (US$52BN +14%)

Johnson & Johnson, also referred to as J&J, secures third place on this year’s top pharmaceutical companies list. With headquarters based in New Jersey, Johnson & Johnson develops and produces pharmaceuticals, medical devices and consumer health goods. Sales for the company’s pharmaceutical division grew by 14% on a year-on-year basis driven by a number of key performers, including Darzalex, a treatment of multiple myeloma, Stelara, a treatment of a number of immune-mediated inflammatory diseases, Tremfya, a plaque psoriasis and psoriatic arthritis treatment, Erleada, a prostate cancer drug, and Invega sustenna/xeplion/Invega trinza/trevicta, an injectable atypical antipsychotic for the treatment of schizophrenia in adults.

In addition, J&J’s single-dose Covid-19 vaccine was approved for emergency use by the FDA in early 2021, which contributed to high growth for the company’s pharma division with revenues of US$2.3bn. However, this was offset by a lacklustre performance for remicade, a treatment for immune-mediated inflammatory diseases.

In January 2022, Joaquin Duato became Johnson & Johnson's new Chief Executive Officer. In J&J’s full-year earnings call he commented "Given our strong results, financial profile, and innovative pipeline, we are well-positioned for success in 2022 and beyond."

2. ABBVIE (US$56.1BN +22%)

Innovation-driven AbbVie is the second largest pharma company by revenue this year. AbbVie was created in 2013, when the company separated from Abbott. Employing 47,000 experts worldwide in 70+ countries, AbbVie tends to drive its R&D efforts towards difficult-to-cure diseases and successfully acquired Allergan, which completed in May 2020, strengthening the company’s position in a number of therapeutic areas including immunology, oncology and neuroscience.

In 2021, AbbVie’s sales totalled US$56.1bn, with year-on-year growth up by an impressive 22%. This was driven by a solid performance for the company’s immunology portfolio which generated sales of $25.28bn, growing by 14.1% on a reported basis and 13.5% on an operational basis. AbbVie’s hematologic oncology and neuroscience portfolios also delivered with sales increasing by 8.7% and 69.5%, respectively.

Looking ahead, AbbVie’s rheumatoid arthritis blockbuster, Humira, is set to face competition in the next year as there are biosimilars on track for early entry. However, there is still expected to be demand for the treatment, Humira. Those sales, plus growing contributions from the Jak inhibitor Rinvoq, psoriasis product Skyrizi and cancer drug Venclexta, are expected to greatly strengthen AbbVie’s market position.

1. PFIZER (US$79.6BN +90%)

Pfizer, takes the top spot in 2022, rising from sixth in 2021. Pfizer, specialises in the development of medicines and vaccines across a wide range of disciplines including immunology, oncology, cardiology and neurology. Last year, their sales were down by 19% as a result of the spin-off of Upjohn, which completed in Q4 2020. Since then, the company has moved forward as a single focused innovative biopharmaceutical company, working on the discovery, development, manufacturing, marketing, sales and distribution of biopharmaceutical products worldwide.

In the fiscal year of 2021, Pfizer’s sales accelerated to an impressive US$79.6bn with their year-on-year growth up 90%, thanks to its top-selling product Comirnaty, a Covid-19 vaccine, which generated sales of almost US$37bn. For the last two years, Pfizer have focussed much of their resources to help provide solutions to the Covid-19 pandemic, which has really strengthened their positioning within the pharmaceutical industry. In 2020, with their partner BioNTech, Pfizer became the first company to successfully develop a vaccine against Covid-19. Since being approved for emergency use, millions of people across the world have been given the Comirnaty vaccine and it has saved countless lives. In December 2021, Pfizer made another major step forward in the fight against the global pandemic when the FDA announced they had approved Paxlovid, the first treatment for Covid-19 that is taken orally in the form of a pill.

Looking ahead, the CEO Albert Bourla has announced plans for the company to aggressively expand the use of the Covid-19 vaccine’s technology, messenger RNA, to treat rare genetic diseases of the liver, muscles, and central nervous system through a collaboration with Beam Therapeutics. The company has also teamed up with BioNTech again to develop a shingles vaccine, which is expected to be the first mRNA-based vaccine to treat the disease.

Main Reference: https://www.proclinical.com/blogs/2022-6/who-are-the-top-10-pharma-companies-in-the-world-2022

.png)

.png)

Comments

Post a Comment